Explaining Differences in Interest Rate Parity

Explain the difference between uncovered interest parity and covered interest parity. Explain how the covered interest parity and uncovered interest parity.

Interest Rate Parity Definition Formula How To Calculate

Interest Rate Parity and Purchasing Power Parity 1.

. Answer Covered Interest Rate Parity Uncovered Interest Rate Parity Covered Interest Rate Parity consist of a forward View the full answer Previous question Next question. Covered IRP shows the forward exchange rate. Interest rate parity is when the difference between interest rates between two countries is equal to the difference in the.

E t S t k S t 1 i 1 i f E t Δ S i i f. Interest Rate Parity The Interest Rate Parity states that the interest rate difference between two countries is equal to the percentage difference between the forward. There are two types of interest rate parity.

Instead parity is simply based on the expected spot rate. Include equations in your answer. Interest Rate Parity IRP 3.

Interest rate parity is a market condition in which the difference between the interest rates of two countries is equal to the difference between their forward exchange rates. Interest rate parity also implies that any deviations from this will result in an arbitrage opportunity allowing investors to make less risk profits. Interest rate parity takes on two distinctive forms.

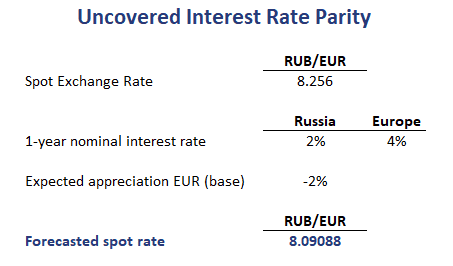

With covered interest parity there is a contract in place locking in the forward. The uncovered interest rate parity UIRP is a no-arbitrage principle that suggests that any interest rate differential between two countries should be completely offset by an adverse movement in the exchange rate. Uncovered IRP shows the spot exchange rate.

In other words any forward premium or discount exactly offsets differences in interest rates. Interest Rate Parity Purchasing power parity Presented by Danish Hasan Ramiz Junaid Zamir 2. Uncovered interest rate parity refers to the parity condition in which exposure to foreign exchange risk unanticipated changes in exchange rates is uninhibited whereas covered interest rate parity refers to the condition in which a forward contract has been used to cover eliminate exposure to exchange rate risk.

Interest rate parity theory assumes that differences in interest rates between two currencies induce readjustment of exchange rate. Covered interest rate parity and uncovered interest rate parity. Interest rate parity IRP plays an essential role in foreign exchange markets.

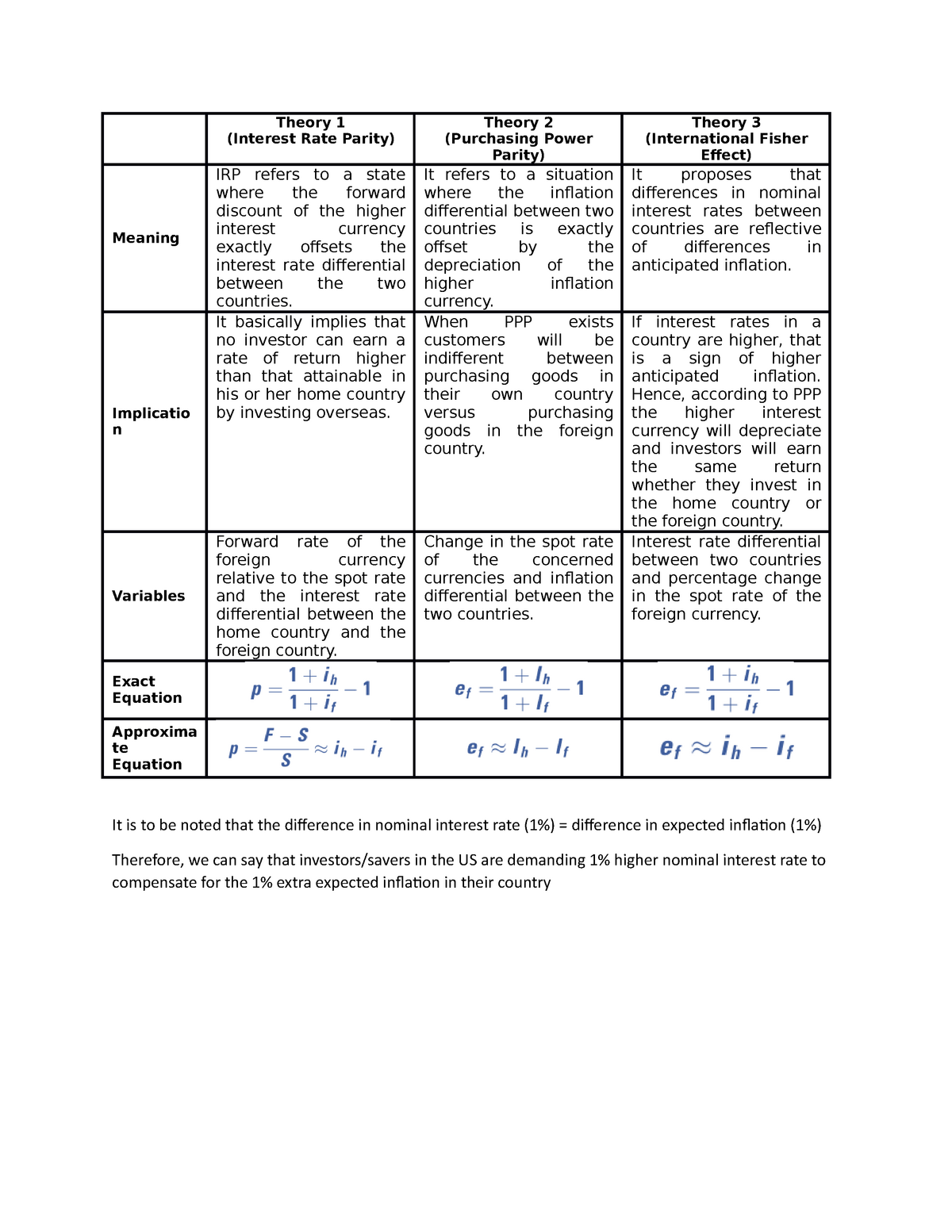

To explain Purchasing Power Parity PPP and International Fisher Effect IFE theories and their implications on exchange rate changes. Uncovered interest rate parity exists when there are no contracts relating to the forward interest rate. There are different interest rate parity equations for covered and uncovered IRP.

It connects interest rates with spot exchange rates and foreign exchange rates. However exchange rates are determined by several other factors and not just. When this no-arbitrage condition exists without the use of forward.

This theory argues that the difference between the risk free interest rates offered for different kinds of currencies. Uncovered interest rate parity UIP theory states that the difference in interest rates between two countries will equal the relative change in currency foreign exchange rates over the same period. And To compare and show linkage between PPP IFE and Interest Rate Parity IRP theories.

In particular the low interest rate currency should be expected to appreciate so much as to render an investor indifferent between 1 investing in the domestic. When discussing foreign exchange rates you may often hear about uncovered and covered interest rate parity. Assuming foreign exchange equilibrium interest rate parity implies that the expected return of a domestic asset will equal the expected return of a foreign asset once adjusted for exchange rates.

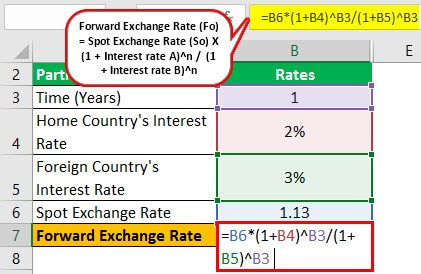

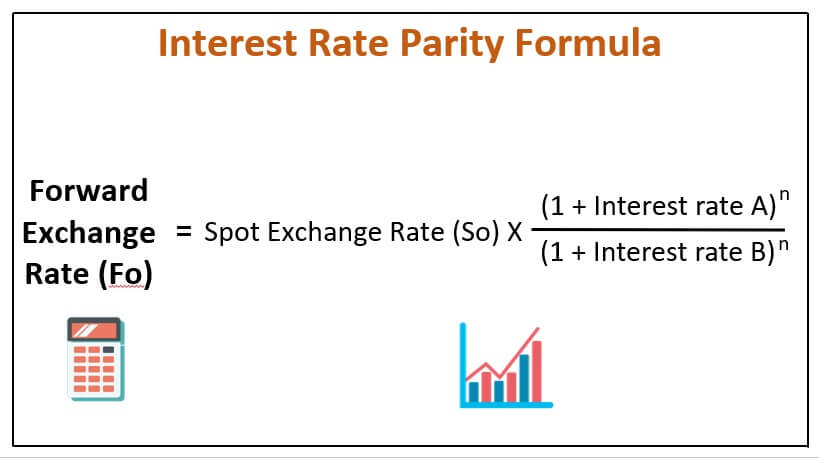

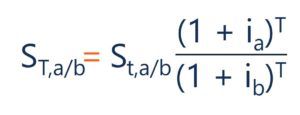

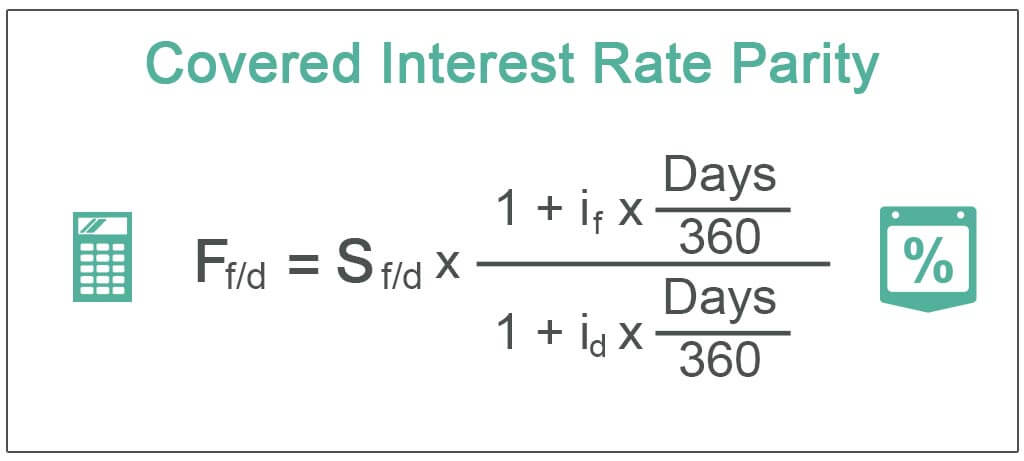

Ftab Stab 1 iaT 1 ibT. Uncovered interest rate parity UIP says that the ratio expected exchange rate E t S t k to spot exchange rate S t has to be equal to nominal interest rates between home i and foreign i f country. Why are forward rates important.

Using the Forward Rate. Heres the uncovered interest rate parity formula. Explain the difference between uncovered interest parity and covered interest parity.

Then covered interest arbitrage is no longer feasible and the equilibrium state achieved is referred to as interest rate parity IRP. Interest Rate Parity IRP As a result of market forces the forward rate differs from the spot rate by an amount that sufficiently offsets the interest rate differential between two currencies. It can be used to predict the movement of exchange rates between two currencies when the risk-free interest rates of the two currencies are known.

The interest rate parity theory is a powerful idea with real implications. According to IRP theory the interest rate differential between two countries is equal to the differential between the forward exchange rate and the spot exchange rate. Include equations in your answer.

In both cases here are. Under the covered interest rate parity the interest rate differential between any two currencies in the cash money markets should equal the differential between the forward and spot exchange rates. Uncovered interest rate parity UIP theory states that the difference in interest rates between two countries will equal the relative change in currency foreign exchange rates over the same period.

STab Stab 1 ia 1 ib The covered interest rate parity formula looks like this.

International Parity Relationships And Forecasting Fx Rates Ppt Video Online Download

Foreign Exchange Implications Of Uncovered Interest Rate Parity Condition Personal Finance Money Stack Exchange

Interest Rate Parity Definition Formula How To Calculate

What Is The Interest Rate Parity Irp Corporate Finance Institute

Macroeconomics How To Interpret Correctly The Uncovered Interest Rate Parity Condition Economics Stack Exchange

What Is The Interest Rate Parity Irp Corporate Finance Institute

Interest Rate Parity In 2021 Mathematical Expression Textbook Finance Definition

Uncovered Interest Rate Parity Uip Definition

The Interest Rate Parity Model

International Parity Conditions Ppt Video Online Download

International Parity Conditions Ppt Video Online Download

Interest Rate Parity Irp Definition

Covered Interest Rate Parity Cirp Definition Formula Example

Chapter 7 International Arbitrage And Interest Rate Parity

Irp Vs Ppp Vs Ift Comparison Between Interest Rate Parity Purchasing Power Parity And Studocu

Interest Rate Parity Meaning Application Types And Equilibrium Rate

Comments

Post a Comment